Understanding BVN Code Check: A Comprehensive Guide

The BVN code check is an essential process for individuals in Nigeria, designed to enhance the security and accessibility of banking services. With the increasing need for digital financial transactions, understanding how to check your BVN is imperative for ensuring your financial security. This article delves into the intricacies of the BVN code check, providing you with all the necessary information to navigate this essential banking feature with confidence.

In this detailed guide, we will cover what a BVN is, why it's important, and how you can easily conduct a BVN code check. Additionally, we will discuss potential issues you may encounter during the process and provide solutions to ensure a seamless experience. By the end of this article, you will be well-equipped to handle your BVN-related inquiries effectively.

Whether you are a seasoned banking user or new to the financial services sector, understanding the BVN code check is crucial. It not only safeguards your identity but also streamlines your banking activities. Let’s dive deeper into the world of BVN and explore its significance in modern banking.

Table of Contents

- What is BVN?

- Importance of BVN

- How to Check BVN

- Common Issues with BVN Code Check

- Solutions to Common Issues

- Conclusion

What is BVN?

The Bank Verification Number (BVN) is an 11-digit unique identifier issued to every bank account holder in Nigeria. The Central Bank of Nigeria (CBN) introduced the BVN initiative to enhance banking security and reduce fraud. Every individual must have a BVN, which links their biometric information, such as fingerprints and facial recognition, to their bank accounts.

With the BVN, customers can access their accounts across multiple banks seamlessly, ensuring that their identities are protected during financial transactions. The BVN is essential for maintaining the integrity of the Nigerian banking system, as it helps to combat identity theft and fraudulent activities.

Importance of BVN

Understanding the importance of BVN is crucial for anyone engaging in banking activities in Nigeria. Here are some key reasons why having a BVN is vital:

- Enhanced Security: The BVN provides an additional layer of security for your bank account by linking it to your biometric data.

- Fraud Prevention: BVN reduces the risk of identity theft and banking fraud, allowing for safer transactions.

- Access to Banking Services: Many banks require a BVN to open an account or access certain services, making it essential for banking operations.

- Financial Inclusion: BVN facilitates access to credit and other financial products, promoting financial inclusion for unbanked individuals.

How to Check BVN

Checking your BVN is a straightforward process that can be done through various methods. Below are the most common ways to check your BVN:

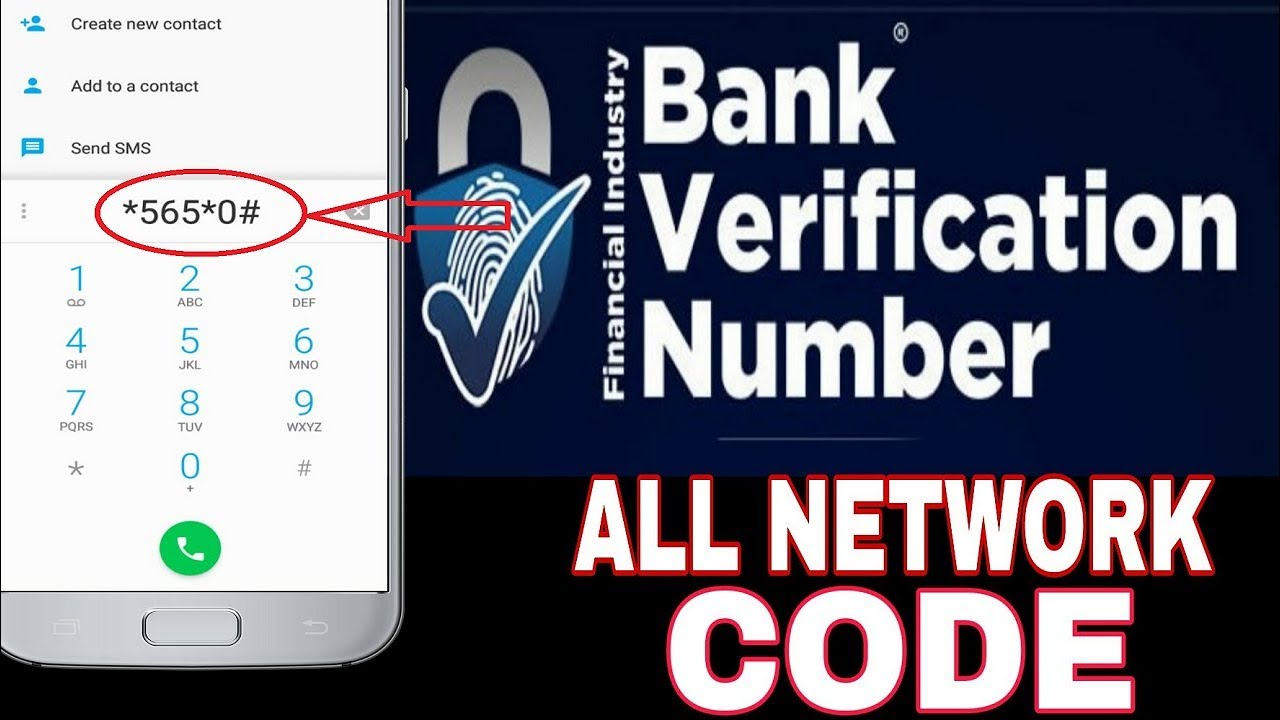

Via USSD Code

One of the easiest ways to check your BVN is by using your mobile phone through USSD codes. Here’s how:

- Dial the USSD code provided by your bank (e.g., *565*0# for some banks).

- Follow the prompts to enter your bank details.

- Your BVN will be displayed on your screen.

Via Online Banking

If you prefer an online approach, you can check your BVN through your bank’s internet banking platform:

- Log in to your internet banking account.

- Navigate to the BVN section, usually found under account settings.

- Your BVN will be displayed there.

Via Bank Customer Service

If you encounter any issues or prefer to speak to someone, you can always contact your bank’s customer service. Provide them with your account details, and they will assist you in retrieving your BVN.

Common Issues with BVN Code Check

While checking your BVN is generally a smooth process, you may encounter some issues. Here are a few common problems:

- Incorrect USSD Code: Dialing the wrong USSD code can lead to unsuccessful attempts to check your BVN.

- Network Issues: Poor network connectivity can hinder the process, especially when using USSD codes.

- Bank-Specific Problems: Each bank may have different procedures or systems that can cause delays or errors.

Solutions to Common Issues

Here are some solutions for the problems you might face while checking your BVN:

- Verify the USSD Code: Always double-check the USSD code provided by your bank.

- Improve Network Connectivity: Ensure you have a strong network signal before attempting to check your BVN.

- Contact Customer Support: If issues persist, reach out to your bank’s customer service for assistance.

Conclusion

In summary, the BVN code check is a crucial aspect of modern banking in Nigeria. It enhances security, prevents fraud, and ensures that all banking activities are conducted safely and efficiently. By following the methods outlined in this article, you can easily check your BVN and maintain control over your banking affairs.

We encourage you to share your experiences or ask questions in the comments section below. Don’t forget to share this article with others who might find it helpful, and check out our other informative articles for more insights into banking and finance.

Thank you for reading, and we look forward to seeing you again on our site!

Meadow Soprano: The Rising Star Of The Acting World

Funny Cat Usernames: The Purrfect Guide To Creating Hilarious Online Identities

Inspirational Sports Quotes In Baseball: Ignite Your Passion For The Game